International Tax Reporting, Filing and Compliance

International tax reporting rules are complex, far-reaching, and aggressively enforced. U.S. taxpayers with foreign accounts, assets, or business interests must comply with strict filing requirements under FATCA and other regulations, while Italian taxpayers face similarly demanding obligations under Section RW. Failure to report can result in significant penalties, making proactive compliance essential. We help clients in both the U.S. and Italy navigate these rules with clarity and confidence.

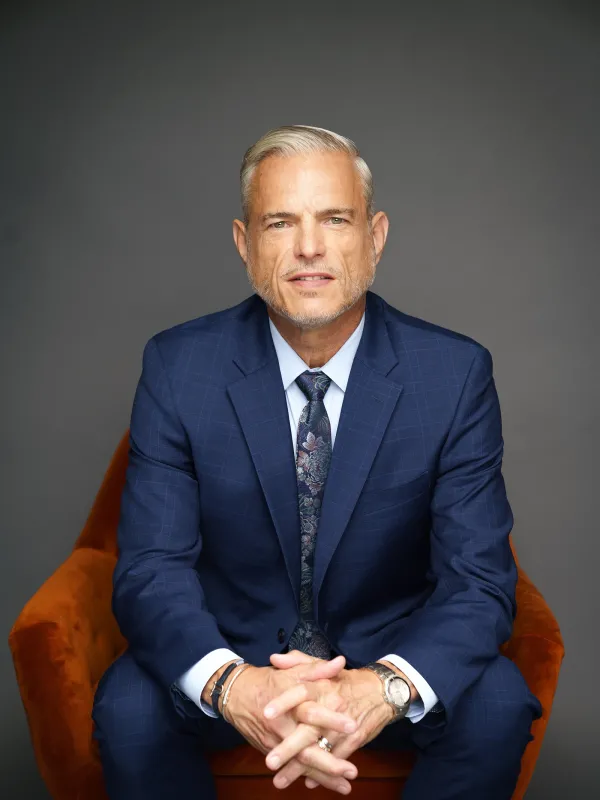

Attorneys

Our attorneys guide individuals and businesses through the full spectrum of U.S. and Italian reporting obligations, including FBAR, FATCA Form 8938, Form 5471 for foreign corporations, Form 8865 for foreign partnerships, and Section RW disclosures in Italy. We also assist clients in utilizing voluntary disclosure and remediation programs to correct past noncompliance while minimizing penalties.

In partnership with Marco Q. Rossi & Associati, (Of Counsel) we provide clients with coordinated U.S. and Italian tax reporting strategies, ensuring obligations are met on both sides of the Atlantic while protecting long-term financial and business interests

Marco Q Rossi & Associati

Marco Q. Rossi & Associati PLLC, Of Counsel — International Tax and Italian Business & Tax Law

Through Marco Q. Rossi & Associati, we maintain an office in Miami that allows us to serve clients seamlessly in Florida while expanding our international reach.

Marco brings deep expertise in U.S. tax law, international (particularly Italian) law, and estate planning, making him an invaluable resource for our clients with cross-border interests.